Things about Chapter 7 Bankruptcy Attorney Tulsa

Table of ContentsTulsa Debt Relief Attorney Things To Know Before You Get ThisBankruptcy Attorney Tulsa Can Be Fun For EveryoneHow Bankruptcy Law Firm Tulsa Ok can Save You Time, Stress, and Money.Tulsa Ok Bankruptcy Attorney for BeginnersGetting The Tulsa Bankruptcy Attorney To Work

The statistics for the various other primary kind, Chapter 13, are even worse for pro se filers. Suffice it to say, talk with a legal representative or two near you who's experienced with insolvency law.Lots of lawyers additionally offer totally free examinations or email Q&A s. Take benefit of that. Ask them if insolvency is certainly the best option for your situation and whether they think you'll certify.

Advertisement Now that you've determined bankruptcy is indeed the appropriate program of action and you with any luck removed it with a lawyer you'll need to get begun on the documents. Before you dive right into all the official insolvency types, you should get your own papers in order.

Facts About Chapter 7 Bankruptcy Attorney Tulsa Revealed

Later on down the line, you'll actually need to verify that by disclosing all sorts of information regarding your economic affairs. Here's a standard list of what you'll need on the roadway in advance: Recognizing records like your copyright and Social Protection card Tax returns (up to the previous four years) Evidence of income (pay stubs, W-2s, independent earnings, earnings from properties as well as any earnings from federal government advantages) Bank declarations and/or pension declarations Evidence of value of your assets, such as lorry and realty valuation.

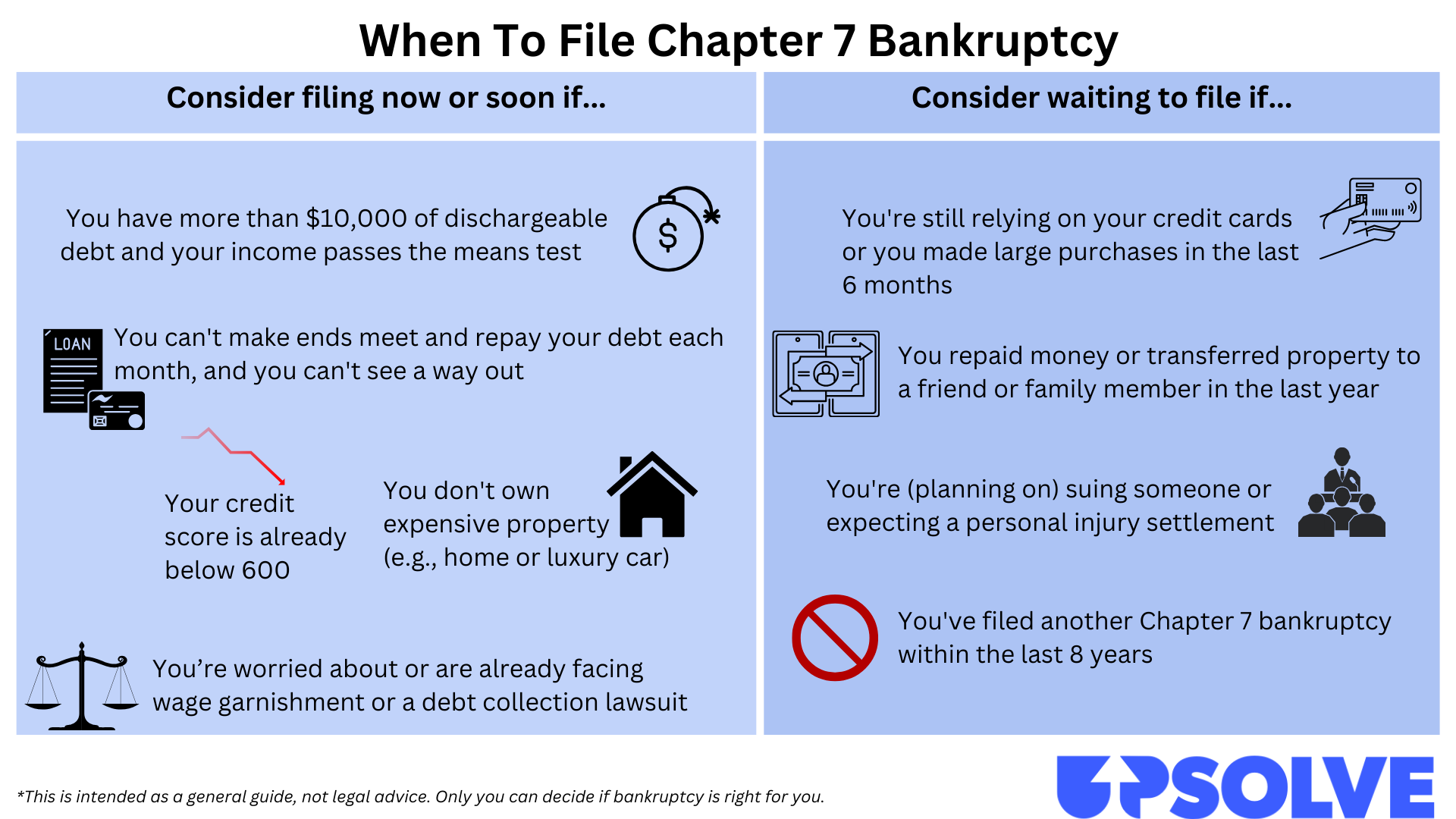

You'll intend to comprehend what type of financial obligation you're attempting to fix. Debts like youngster support, alimony and particular tax obligation financial obligations can not be released (and insolvency can not stop wage garnishment pertaining to those financial obligations). Trainee lending financial debt, on the various other hand, is possible to discharge, yet keep in mind that it is tough to do so (Tulsa bankruptcy lawyer).

You'll intend to comprehend what type of financial obligation you're attempting to fix. Debts like youngster support, alimony and particular tax obligation financial obligations can not be released (and insolvency can not stop wage garnishment pertaining to those financial obligations). Trainee lending financial debt, on the various other hand, is possible to discharge, yet keep in mind that it is tough to do so (Tulsa bankruptcy lawyer).If your earnings is expensive, you have one more alternative: Chapter 13. This choice takes longer to fix your debts because it calls for a long-term payment strategy generally three to 5 years before some of your remaining financial debts are wiped away. The declaring procedure is also a whole lot more intricate than Phase 7.

The Best Guide To Experienced Bankruptcy Lawyer Tulsa

A Chapter 7 insolvency remains on your credit scores record for 10 years, whereas a Phase 13 bankruptcy drops off after seven. Before you send your bankruptcy forms, you must initially finish an obligatory training course from a credit score therapy company that has actually been Tulsa OK bankruptcy attorney accepted by the Department of Justice (with the notable exemption of filers in Alabama or North Carolina).

The training course can be finished online, in individual or over the phone. You should finish the program within 180 days of filing for insolvency.

The smart Trick of Top-rated Bankruptcy Attorney Tulsa Ok That Nobody is Talking About

An attorney will commonly handle this for you. If you're filing on your own, understand that there are regarding 90 various personal bankruptcy areas. Inspect that you're submitting with the appropriate one based on where you live. If your irreversible home has moved within 180 days of filling, you must file in the area where you lived the greater part of that 180-day period.

Normally, your personal bankruptcy attorney will certainly work with the trustee, however you might require to send out the individual documents such as pay stubs, tax returns, and financial institution account and credit report card statements directly. An usual false impression with insolvency is that as soon as you file, you can stop check out the post right here paying your financial obligations. While personal bankruptcy can aid you clean out several of your unsecured debts, such as overdue clinical costs or personal lendings, you'll desire to maintain paying your monthly settlements for guaranteed financial obligations if you desire to maintain the property.

An Unbiased View of Chapter 7 Bankruptcy Attorney Tulsa

If you're at risk of repossession and have exhausted all various other financial-relief choices, then applying for Chapter 13 might postpone the repossession and assistance conserve your home. Eventually, you will certainly still require the income to proceed making future mortgage payments, along with paying off any late repayments over the program of your layaway plan.

If so, you may be needed to supply additional info. The audit could delay any kind of debt alleviation by several weeks. Obviously, if the audit transforms up wrong information, your instance can be rejected. All that said, these are fairly rare instances. That you made it this much at the same time is a respectable indicator a minimum of some of your financial obligations are qualified for discharge.